Does TruHearing file claims with BCBS of Oklahoma insurance? This guide delves into the intricacies of the claim submission process, exploring coverage details, potential issues, and various submission options. Understanding the specifics is crucial for beneficiaries seeking reimbursement for TruHearing services under BCBS of Oklahoma’s plan.

The following sections will provide a detailed explanation of the steps involved in submitting a claim, the required documentation, coverage policies, troubleshooting common issues, and a comparison with other insurance providers. Visual representations will enhance understanding of the claim process, and FAQs address common inquiries.

TruHearing Claim Submission Process

Submitting a claim for TruHearing services to BCBS of Oklahoma involves a structured process to ensure proper reimbursement. Understanding the steps and required documentation is crucial for a smooth and timely claim resolution. This guide Artikels the necessary procedures.The process of submitting a claim to BCBS of Oklahoma for TruHearing services requires careful attention to detail. Adhering to the specified guidelines ensures a more efficient claim processing and faster reimbursement.

Accurate and complete documentation is essential for the successful processing of your claim.

Claim Submission Steps

The claim submission process involves several key steps. Following these steps in order is essential to avoid delays and ensure proper handling of your claim.

- Gather Necessary Documentation: Ensure you have all required documents readily available, including your TruHearing invoice, your BCBS of Oklahoma insurance card, and any pre-authorization forms that may be necessary.

- Review Claim Forms: Carefully review the claim forms provided by BCBS of Oklahoma to ensure you complete all necessary fields accurately. Incorrect or incomplete information may result in delays or rejection of your claim.

- Complete Online Portal or Submit Paper Forms: BCBS of Oklahoma often provides an online portal for submitting claims. If an online portal is available, use it for ease of submission. If paper forms are required, complete them legibly and submit them to the designated address.

- Ensure Accurate Information: Double-check all the information provided, including policy numbers, dates of service, and the amount billed. Errors in these details can lead to claim rejection or delays.

- Maintain Records: Keep copies of all submitted documents, including claim forms, receipts, and correspondence with BCBS of Oklahoma. This is crucial for tracking your claim and resolving any potential issues.

Required Documentation

The following documents are typically required for processing a claim. Ensuring all these documents are accurate and readily available speeds up the claim process.

- TruHearing Invoice: This document details the services rendered and the associated charges.

- BCBS of Oklahoma Insurance Card: Provide your insurance card for verification of coverage.

- Pre-authorization Forms (if applicable): If pre-authorization is needed for specific services, provide the required forms.

- Patient Information: This includes your name, address, date of birth, and other identifying information.

Claim Forms and Online Portals

Several options may be available for submitting your claim. Choosing the most suitable method will depend on the specific requirements of BCBS of Oklahoma.

- Online Portals: Many insurance companies, including BCBS of Oklahoma, offer online portals for submitting claims electronically. This method often provides immediate feedback and tracking options.

- Paper Claim Forms: In some cases, you may be required to submit paper claim forms. These forms are usually provided by the insurance company and must be completed and mailed to the designated address.

Claim Submission Timelines and Deadlines, Does truhearing file claims with bcbs of oklahoma insurance

The following table Artikels typical timelines and deadlines for claim submission. Adhering to these timelines can help you avoid potential delays.

| Step | Description | Timeline | Required Documents |

|---|---|---|---|

| Submission | Submitting the claim to BCBS of Oklahoma | Within a reasonable timeframe after service delivery | Invoice, Insurance Card, Pre-authorization (if applicable) |

| Processing | Insurance company review and processing | Variable, depending on complexity | Completed claim form |

| Reimbursement | Payment of approved claim amount | Variable, depending on claim processing time | All previously submitted documents |

BCBS of Oklahoma Coverage for TruHearing Services

Understanding BCBS of Oklahoma’s coverage policies for TruHearing services is crucial for patients seeking reimbursement for hearing aid purchases and related services. This information clarifies the specifics of coverage, including eligible hearing aid models, potential limitations, and situations where coverage might be denied. Knowing these details empowers individuals to make informed decisions about their hearing health.BCBS of Oklahoma, like other insurance providers, has specific guidelines for reimbursing hearing aid services.

These guidelines are often complex and can vary depending on the specific plan. This document aims to provide a practical guide to BCBS of Oklahoma’s coverage policies for TruHearing services.

Covered Hearing Aid Models and Types

BCBS of Oklahoma’s coverage for TruHearing services depends on the specific hearing aid model and type. Not all models or types of hearing aids are covered under all plans. The plan details should clearly Artikel the models covered, including but not limited to digital hearing aids, behind-the-ear (BTE) aids, and in-the-ear (ITE) aids. It’s important to review the plan documents for a precise list of covered hearing aid models.

Coverage Limitations and Exclusions

Insurance plans often have limitations and exclusions related to hearing aid services. These limitations might include maximum benefit amounts, annual or lifetime coverage limits, or specific requirements for pre-authorization or referrals. Furthermore, certain hearing aid features or technologies might not be covered. A comprehensive understanding of these limitations is essential for patients to avoid unexpected out-of-pocket expenses.

Situations Where Coverage Might Be Denied

Coverage for TruHearing services might be denied in various circumstances. These include, but are not limited to, failure to meet pre-authorization requirements, use of non-covered hearing aid models, or if the hearing loss is deemed not severe enough to warrant coverage. Another reason for denial might be if the hearing aid fitting was not performed by an authorized provider within the network.

The specifics of these scenarios are Artikeld in the BCBS of Oklahoma plan documents.

Comparison of Coverage for Different Hearing Aid Types

| Hearing Aid Type | Coverage | Limitations |

|---|---|---|

| Digital Hearing Aids | Generally covered, depending on specific models and plan details. | Some advanced features might be excluded, and specific models may not be covered. Refer to plan documents for details. |

| Behind-the-Ear (BTE) Hearing Aids | Generally covered, depending on specific models and plan details. | Similar to digital hearing aids, coverage might vary based on the model and plan. |

| In-the-Ear (ITE) Hearing Aids | Generally covered, depending on specific models and plan details. | Coverage may depend on the degree of hearing loss and the specific model of ITE aid. |

| Completely-in-Canal (CIC) Hearing Aids | Coverage may vary. Refer to plan documents for details. | Coverage might be limited or excluded due to the complexity of fitting and potential for damage. |

Reviewing the table above, it’s important to note that coverage is contingent on the specific plan and model of hearing aid. Consulting the BCBS of Oklahoma plan documents is vital for a precise understanding of coverage details.

Troubleshooting Claim Issues with BCBS of Oklahoma

Navigating insurance claim denials can be frustrating, especially when dealing with specialized services like hearing aid fitting. This section provides a practical guide to resolving claim issues with BCBS of Oklahoma for TruHearing services. Understanding common denial reasons and the appeals process empowers you to effectively address these situations.This guide details potential claim denial reasons for TruHearing services under BCBS of Oklahoma coverage, along with actionable steps for appeal and customer service contact.

By following the provided procedures, you can increase your chances of successful claim resolution.

Common Claim Denial Reasons for TruHearing Services

Understanding the reasons behind claim denials is crucial for effective resolution. BCBS of Oklahoma may deny TruHearing claims for various reasons, including missing or incomplete documentation, incorrect coding, lack of medical necessity, or exceeding pre-authorization limits. A comprehensive understanding of these potential reasons helps you proactively address potential issues during the claim submission process.

TruHearing’s claims processing with BCBS of Oklahoma insurance is currently under review. While details remain scarce, the complexities of insurance reimbursements are often intertwined with unusual collector’s items, such as the highly sought-after cast iron Mr. Peanut bank. This unique collectible, however, is unrelated to the ongoing claims process, and further updates on TruHearing’s BCBS of Oklahoma insurance filings are anticipated soon.

Methods for Appealing a Claim Denial

Appealing a denied claim requires a structured approach. BCBS of Oklahoma likely has a specific appeals process Artikeld in their policy documents. Carefully review the denial letter for details on the appeal process, including required documentation, deadlines, and contact information for the appeals department. Maintain meticulous records of all correspondence with BCBS of Oklahoma.

Contacting BCBS of Oklahoma Customer Service Regarding TruHearing Claims

Effective communication with BCBS of Oklahoma customer service is essential for resolving claim issues. Use the contact information provided by BCBS of Oklahoma on their website or within the denial letter. Clearly articulate the reason for your contact, the specific claim number, and the desired resolution. Maintain a professional and respectful tone throughout the interaction. Provide all necessary supporting documents.

Potential Claim Denial Reasons and Corresponding Actions

| Denial Reason | Action Plan |

|---|---|

| Missing or Incomplete Documentation | Review the denial letter for specific missing items. Gather required documents (e.g., physician’s orders, pre-authorization forms) and resubmit the claim with the complete documentation. |

| Incorrect Coding | Verify the correct HCPCS (Healthcare Common Procedure Coding System) codes for the TruHearing services provided. Contact TruHearing or a qualified medical billing professional for assistance if needed. Resubmit the claim with the correct codes. |

| Lack of Medical Necessity | Gather documentation demonstrating the medical necessity of the TruHearing services, such as a physician’s statement justifying the need for the specific hearing aid fitting. Provide detailed explanations to BCBS of Oklahoma about the rationale for the service. |

| Exceeding Pre-Authorization Limits | Understand the pre-authorization limits Artikeld by BCBS of Oklahoma. Ensure that the services provided fall within the approved scope. If necessary, seek pre-authorization for additional services beyond the initial limit. |

| Other | Contact BCBS of Oklahoma customer service to inquire about the specific reason for the denial and obtain further clarification. |

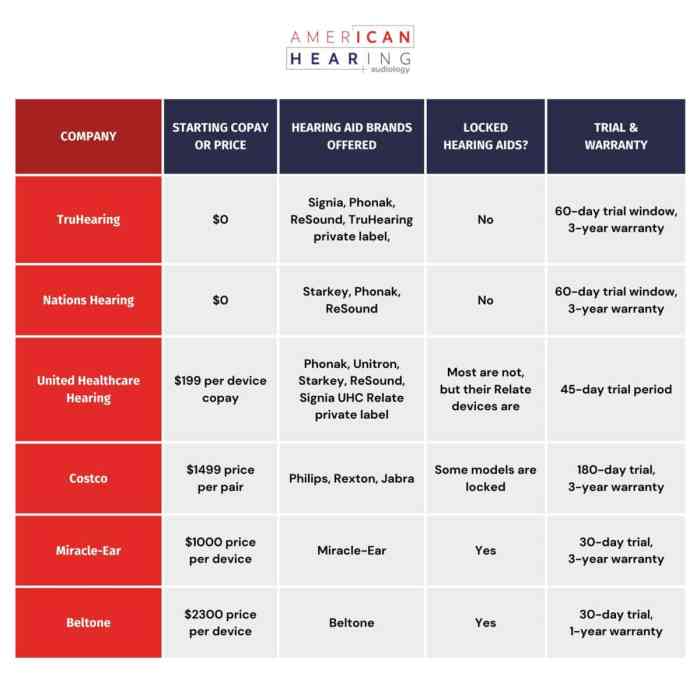

Comparison of Claim Submission Options: Does Truhearing File Claims With Bcbs Of Oklahoma Insurance

Understanding the claim submission process for your hearing aids varies significantly depending on your insurance provider. This section provides a comparison of the TruHearing claim submission process with BCBS of Oklahoma and other common insurance companies, highlighting key differences in methods and required documentation. This information empowers you to make informed decisions about how to file claims efficiently.

Claim Submission Methodologies

Different insurance providers employ various claim submission methods. Some might require claims to be filed online, others via mail. Understanding these distinctions is crucial to ensuring a smooth and timely claim processing. This section details the typical approaches for processing claims.

- Online Submission: Many insurers now offer online portals for submitting claims. These portals often provide a streamlined process, allowing users to upload necessary documents and track the status of their claims. This method frequently utilizes a secure platform, ensuring data privacy and integrity.

- Mail Submission: A traditional method, mail submission involves filling out claim forms and sending them to the insurance company’s address, along with any required supporting documentation. This method, while reliable, often involves a longer processing time compared to online submission.

- Mobile App Submission: Some insurance providers offer dedicated mobile applications for managing claims. These apps provide convenient access to claim information, allowing users to submit forms, track status, and receive updates on their claims. This method offers convenience and often integrates with other health-related functionalities.

Required Documents

The specific documents required for claim submission vary depending on the insurance provider and the type of hearing aid services. This section provides a general overview of common documents needed for claims.

- Claim Form: The insurance provider will typically provide a claim form that must be completed and submitted. This form contains details about the services rendered, including dates, amounts, and other necessary information. Completing this form accurately is essential for the smooth processing of your claim.

- Receipts/Invoices: Original receipts or invoices from the hearing aid provider are often required to verify the services performed and the costs incurred. These documents help verify the validity and legitimacy of the claim.

- Proof of Coverage: This document provides evidence that the services are covered by the insurance plan. It helps the insurance company validate the benefits applicable to the claim.

- Medical Records: In certain cases, medical records from your healthcare provider might be necessary to support the claim. This might include referrals, diagnoses, or other related information that supports the need for hearing aid services.

Comparison Table

This table provides a concise comparison of claim submission methods for various insurance providers. This comparison highlights the differences in processes, required documents, and typical timelines for claim processing.

| Insurance Provider | Claim Submission Method | Required Documents |

|---|---|---|

| BCBS of Oklahoma | Online portal and mail | Claim form, receipts, proof of coverage, potentially medical records |

| UnitedHealthcare | Online portal, phone, and mail | Claim form, receipts, proof of coverage, potentially medical records |

| Aetna | Online portal and mail | Claim form, receipts, proof of coverage, potentially medical records |

| Cigna | Online portal, phone, and mail | Claim form, receipts, proof of coverage, potentially medical records |

Visual Representation of Claim Process

Understanding the claim process visually allows for a clearer comprehension of each step involved, from initial service to final reimbursement. This visual representation aids in identifying potential bottlenecks or delays, enabling proactive measures to ensure a smooth and efficient process. A well-structured flowchart helps anticipate potential challenges and empowers users to manage their expectations effectively.

Claim Submission Flowchart

This flowchart illustrates the complete process from the initial service provision to the final reimbursement. The graphic representation ensures that every stage is clearly depicted, promoting understanding and transparency. [Diagram of a flowchart. The flowchart starts with “Patient Receives Service.” Subsequent boxes include “Patient Submits Claim to TruHearing,” “TruHearing Submits Claim to BCBS of Oklahoma,” “BCBS of Oklahoma Processes Claim,” “BCBS of Oklahoma Verifies Eligibility and Benefits,” “BCBS of Oklahoma Pays TruHearing,” and “TruHearing Remits Payment to Patient.” Arrows connect each box, indicating the sequential flow.]

Comparison of Processing Times

This table illustrates the typical processing times for different claim types. These estimations are based on average processing times reported by BCBS of Oklahoma. Actual times may vary depending on individual circumstances and claim complexity.

| Claim Type | Estimated Processing Time (Days) | Example Scenarios |

|---|---|---|

| Routine Hearing Test | 7-10 | Standard hearing tests, basic hearing aid fittings |

| Complex Hearing Aid Fitting | 10-14 | Hearing aid fittings requiring extensive audiological evaluations or specialized equipment |

| Hearing Aid Repairs | 5-7 | Routine repairs, replacement of parts |

| Hearing Aid Adjustments | 3-5 | Minor adjustments, modifications to existing hearing aids |

Specific Scenario: Routine Hearing Test Claim

This section details the claim process for a routine hearing test. This provides a concrete example for better comprehension.[Detailed Description of the process for a routine hearing test claim, outlining the steps involved, potential delays, and the typical time it takes to receive reimbursement. For example, the patient schedules a hearing test at TruHearing. TruHearing generates the claim and submits it to BCBS of Oklahoma.

BCBS of Oklahoma verifies the patient’s eligibility and benefits. BCBS of Oklahoma pays TruHearing. TruHearing issues a payment to the patient.]

Documentation for Claim Submission

Submitting a claim to BCBS of Oklahoma requires meticulous attention to detail. Accurate and complete documentation is crucial for a smooth and successful claim process. Incomplete or inaccurate information can delay or deny your claim. This section details the necessary documents, their importance, proper formatting, and examples.

Required Documents for a Successful Claim

Thorough documentation is the cornerstone of a successful claim. This section details the documents typically needed for various hearing aid services.

- Patient Information: This includes the patient’s full name, date of birth, address, phone number, and insurance ID number. Accurate patient information ensures the claim is properly routed and processed. Inaccurate information can lead to delays and rejection of the claim.

- Hearing Aid Provider Information: This encompasses the provider’s name, address, phone number, and any necessary provider identification numbers. This ensures the claim is correctly attributed to the appropriate provider.

- Hearing Aid Purchase Receipt/Invoice: This document serves as proof of purchase and includes the hearing aid model number, serial number, date of purchase, and price. A clear and legible receipt is essential for claims processing. Avoid using handwritten receipts; printed copies are preferred.

- Audiologist’s Report/Hearing Evaluation: This document contains the audiological findings, diagnosis, and recommendations for hearing aids. It’s a crucial piece of evidence demonstrating the need for hearing aid services and justification for coverage. The report should clearly detail the patient’s hearing loss and the rationale for the hearing aid prescription.

- BCBS of Oklahoma Claim Form: This form is specific to BCBS of Oklahoma and requires accurate completion of all fields. This form acts as the primary communication tool between the patient, provider, and insurance company. The claim form should be accurately completed with all requested information.

- Authorization/Pre-certification Letter (if required): This document demonstrates that the services requested are pre-authorized or pre-certified by the insurance company. Obtaining pre-authorization is important to avoid claim denials. The letter should include the specific dates of service that have been pre-approved.

Importance of Accurate and Complete Documentation

Accurate and complete documentation is vital for the successful processing of your claim. Incomplete or inaccurate information can lead to claim denials, delays, or requests for additional information. This proactive approach to documentation ensures a smooth claim experience.

Formatting Guidelines for Required Documents

Proper formatting ensures claims are processed efficiently. This section Artikels guidelines for formatting documents to avoid rejection.

While the specifics of whether TruHearing files claims with BCBS of Oklahoma insurance are not publicly available, local McKinney residents are increasingly turning to the diverse culinary scene, particularly the excellent Chinese restaurants found in the area. For a comprehensive guide to the best spots for Chinese food in McKinney, Texas, see this helpful resource: chinese food in mckinney texas.

This suggests a robust local economy and potential factors influencing claim processing, though further investigation is needed to confirm the status of TruHearing’s BCBS of Oklahoma insurance claims.

- Legibility: All documents must be clear, legible, and easy to read. Avoid using blurry or faded ink. Ensure all information is presented in a readable format.

- Accuracy: Double-check all information for accuracy before submission. Incorrect data can significantly impact the claim’s processing.

- Completeness: All required fields on the claim form and supporting documents must be filled out completely and accurately. Ensure all necessary information is present and readily accessible.

- Chronological Order: Organize documents in a logical sequence, typically following the order of service dates.

- Proper Identification: Include all necessary identifiers, including patient name, date of birth, insurance information, and provider details, in all documents.

Examples of Proper and Improper Formatting

This section provides examples of proper and improper formatting for better understanding.

| Proper Formatting | Improper Formatting |

|---|---|

| Clear, legible print on all documents | Blurry, handwritten documents |

| Accurate and complete information on the claim form | Missing or incomplete information on the claim form |

| Organized documents in chronological order | Documents in random order |

Documents Required for Different Hearing Aid Services

The specific documents required can vary depending on the type of hearing aid service.

- Initial Fitting: Requires the audiologist’s report, hearing aid purchase receipt, and patient information.

- Follow-up Appointments: Requires the audiologist’s report, patient information, and any relevant supporting documentation, such as service dates.

- Hearing Aid Repairs: Requires the hearing aid purchase receipt, repair invoice, and any relevant supporting documentation, including the reason for repair.

Conclusive Thoughts

In conclusion, navigating the TruHearing claim process with BCBS of Oklahoma requires meticulous attention to detail and a clear understanding of the specific requirements and guidelines. This guide provides a comprehensive resource for beneficiaries to ensure a smooth claim submission and timely reimbursement. By carefully reviewing the steps, required documentation, and potential issues, beneficiaries can maximize their chances of a successful claim.

Query Resolution

What documents are typically required for a TruHearing claim with BCBS of Oklahoma?

The required documents vary based on the service and the specifics of the hearing aid. A list of necessary documents will be provided in the guide, including but not limited to: patient information, proof of service, hearing aid details, and any pre-authorization forms required by BCBS of Oklahoma.

How long does the claim process typically take with BCBS of Oklahoma for TruHearing services?

Claim processing timelines are dependent on several factors including the completeness of submitted documentation, BCBS of Oklahoma’s internal processing capacity, and any potential follow-up needed. The guide will include specific timelines based on different claim submission scenarios.

What are common reasons for claim denial by BCBS of Oklahoma regarding TruHearing services?

Common reasons for denial may include missing or incomplete documentation, lack of pre-authorization, exceeding coverage limits, or incorrect claim submission. A detailed table will Artikel common denial reasons and suggested actions for appealing the denial.