Authorization letter format for bank transactions is crucial for secure financial dealings. This comprehensive guide delves into the intricacies of these letters, from their essential elements to the legal implications and security considerations. Whether you’re initiating a loan application, making a payment, or transferring funds, understanding the proper format is paramount to a smooth and legally sound process.

We will explore the different types of authorization letters, their necessary components, and how to tailor them to specific situations, ensuring your financial transactions are handled with precision and care.

Navigating the world of banking transactions can be complex. This resource simplifies the process by providing a clear and concise format for authorization letters. From the crucial clauses to the various transaction types, we’ll equip you with the knowledge to confidently handle your banking authorizations.

Introduction to Authorization Letters for Banks

An authorization letter for bank transactions is a formal document that grants a specific individual or entity the authority to perform certain actions on behalf of another party related to their bank account. This document Artikels the permitted transactions, ensuring accountability and preventing unauthorized access to financial resources. These letters are crucial for safeguarding assets and facilitating secure financial dealings.Authorization letters play a vital role in various banking processes, providing a legally binding agreement for both the authorizing party and the authorized party.

They are essential for ensuring transactions are conducted with the explicit consent of the account holder, preventing fraud and protecting the financial interests of all involved.

Types of Authorization Letters

Authorization letters in banking come in various forms, each tailored to specific financial transactions. Common types include withdrawal authorizations, payment authorizations, and loan authorizations. Withdrawal authorizations permit someone to access funds from a bank account on behalf of the account holder. Payment authorizations allow for the transfer of funds from one account to another, while loan authorizations enable an authorized party to act on behalf of a borrower for loan-related matters.

Importance of Authorization Letters

Authorization letters are paramount in maintaining the integrity and security of financial transactions. They serve as a crucial safeguard against fraudulent activities and ensure that all transactions are conducted with the explicit consent of the account holder. This formal documentation acts as proof of authorization, reducing the risk of disputes and misunderstandings. The specific type of authorization letter directly corresponds to the nature of the financial action, emphasizing the importance of clarity and specificity.

Key Elements of a Well-Structured Authorization Letter

A well-crafted authorization letter is characterized by clear and concise language, avoiding ambiguity. It must precisely define the authorized actions, the timeframe for the authorization, and the specific account(s) involved. Furthermore, the letter should clearly identify both the authorizing party and the authorized party, providing their full names and addresses. The letter should include the date of authorization, the signature of the authorizing party, and any relevant supporting documents.

This ensures the authenticity and validity of the authorization.

Table: Types of Authorization Letters

| Type of Authorization | Purpose | Key Information Required |

|---|---|---|

| Withdrawal Authorization | Allows another party to withdraw funds from an account. | Account number, amount, date range, authorized party’s name and signature, authorizing party’s name and signature. |

| Payment Authorization | Enables another party to make payments from an account. | Account number, recipient details (name, account number, payment amount, payment date), authorizing party’s name and signature, authorized party’s name and signature. |

| Loan Authorization | Authorizes a third party to act on behalf of a borrower in loan-related matters. | Loan application details, account numbers, authorized party’s name and signature, authorizing party’s name and signature, loan amount, loan term. |

Format and Structure of the Authorization Letter

An authorization letter for bank transactions is a crucial document that grants explicit permission to a designated individual or entity to perform specific actions on your behalf. Its proper format and structure are vital to ensure legal validity and prevent misunderstandings. A well-structured letter clearly Artikels the authorized actions, the scope of the authorization, and the validity period.Authorization letters for banks require a meticulous structure to ensure clarity and legal enforceability.

They serve as a formal agreement between the authorizer and the authorized party, providing a clear understanding of the permissions granted. This precision is critical to protect both parties from potential disputes or misinterpretations.

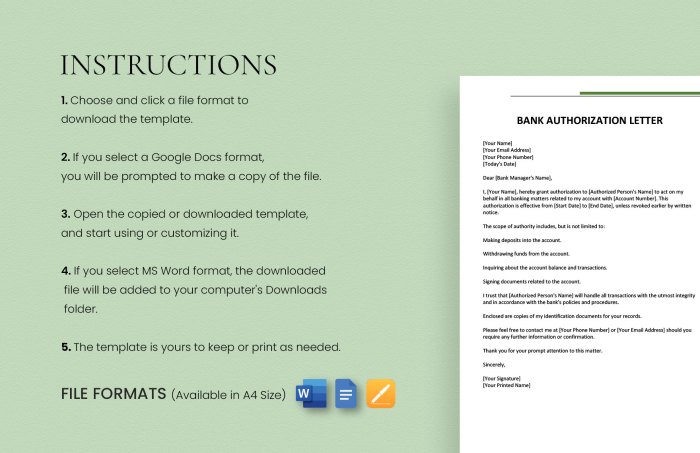

Sample Format for Bank Transaction Authorization

This sample format provides a comprehensive template for an authorization letter, incorporating essential clauses and sections. The specific details must be tailored to the particular transaction and circumstances.

[Your Name/Company Name]

[Your Address]

So, you need a bank authorization letter? Totally get it. Finding the right format can be a total drag, but it’s totally essential, especially when you’re lookin’ for a new place like Oakwood Villa Apartments Jacksonville FL oakwood villa apartments jacksonville fl. You gotta make sure everything’s legit, ya know? Good thing there are tons of resources online to help you nail that perfect format for your bank authorization letter.

[Your Phone Number]

[Your Email Address]

Date: [Date]

To: [Bank Name]

Branch: [Branch Location]

Subject: Authorization for [Specific Transaction Type, e.g., Funds Transfer]

Authorization Granted to: [Authorized Person/Company Name]

Address: [Authorized Person/Company Address]

This letter serves as authorization to [Authorized Person/Company Name] to [Specify transaction type, e.g., transfer funds from account [Account Number] to account [Account Number]].

Purpose: [Clearly state the purpose of the transaction, e.g., payment for goods/services].

Amount: [Specify the exact amount, if applicable].

So, you need a bank authorization letter? Totally get it. It’s kinda a pain, but essential. Plus, you know, gotta have that right format. Speaking of essentials, if you’re rocking a killer sound system, like the King Tour Pack speaker pods , you’ll need a proper authorization for bank transfers for all those sweet tunes.

Basically, the format is key for smooth transactions. Gotta get that paperwork straight, you know?

Validity Period: [State the duration of authorization, e.g., valid until [Date]].

Account Number(s): [List all relevant account numbers].

Signature: [Your Signature]

Printed Name: [Your Printed Name]

Significance of Each Section

Each section within the authorization letter plays a critical role in its overall effectiveness. The specific details and wording within each section are crucial for clarity and legal validity. For instance, a precise statement of the transaction’s purpose can prevent ambiguity and potential fraud.

| Section | Content |

|---|---|

| Date | Specifies the date the authorization was issued. |

| Recipient | Identifies the recipient of the authorization. |

| Subject | Clearly states the purpose of the authorization. |

| Authorized Party | Identifies the individual or entity authorized to act. |

| Transaction Details | Includes specifics like amount, account numbers, and purpose. |

| Validity Period | Defines the duration of the authorization. |

| Signatures | Includes signatures for verification and authentication. |

Examples of Appropriate Wording

Clear and concise wording is paramount for effective authorization letters.

- Authorizing a specific transaction: “I hereby authorize ABC Company to transfer $1,000 from my account, [Account Number], to XYZ Company’s account, [Account Number], for the purchase of [Product Name].”

- Authorizing recurring transactions: “This letter authorizes [Authorized Person] to make monthly payments of [Amount] from my account [Account Number] to [Recipient Name/Company] for [Purpose].”

- Limiting the scope of authorization: “This authorization is strictly limited to the transfer of funds from my account to [Authorized Person/Company] for [Purpose]. No other transactions are authorized.”

Essential Clauses and Components

Authorization letters for bank transactions are crucial legal documents. Their precise wording and inclusion of essential clauses directly impact the validity and enforceability of the agreement. Understanding these components is vital for both the authorizing party and the recipient, minimizing potential disputes and ensuring smooth transactions.Careful consideration of each clause is paramount. Omitting critical elements can lead to significant legal repercussions.

This section delves into the mandatory clauses, their importance, and potential risks associated with their absence. A structured understanding of these clauses is key to preventing future complications.

Mandatory Clauses

Authorization letters for bank transactions demand meticulous attention to detail. The inclusion of specific clauses is not merely a formality; it’s a cornerstone of legal protection. Without these essential components, the letter lacks the necessary strength to be legally binding.

Date

The date is a fundamental element of any authorization letter. It unequivocally establishes the time frame when the authorization was granted. Its absence renders the letter uncertain and potentially invalid. In cases of disputes, the date serves as a crucial reference point for determining the validity of the transaction.

Signatures

Signatures provide irrefutable proof of the authorizing party’s consent. The signatures must be authentic and verifiable to ensure the letter’s legitimacy. Without properly executed signatures, the authorization lacks legal standing.

Validity Period

The validity period defines the duration for which the authorization remains effective. This clause clearly Artikels the timeframe within which the authorized party can execute the transaction. Failure to specify a validity period may result in ambiguity and potential challenges to the authorization’s legitimacy.

Specific Transaction Details

A clear and detailed description of the transaction is essential. This includes the amount, the account numbers involved, and the purpose of the transaction. Without this crucial information, the recipient cannot properly identify and execute the transaction. The absence of these specifics leaves room for misinterpretation and potential errors.

Table of Clauses

| Clause | Description | Legal Implications |

|---|---|---|

| Date | Specifies the exact time the authorization was granted. | Absence renders the letter uncertain and potentially invalid. |

| Signatures | Authenticate the authorizing party’s consent. | Lack of authentic signatures weakens the letter’s legal standing. |

| Validity Period | Defines the timeframe for executing the transaction. | Omitting this can lead to ambiguity and challenges to the authorization’s legitimacy. |

| Specific Transaction Details | Clearly Artikels the transaction’s specifics (amount, accounts, purpose). | Absence of details can lead to misinterpretation and errors, impacting the validity and execution of the transaction. |

Legal Considerations

Authorization letters for bank transactions carry significant legal weight. Properly drafted letters act as legally binding agreements, outlining the scope of authority granted and protecting both the authorizing party and the recipient bank from potential liabilities. Conversely, poorly constructed letters can lead to legal complications and financial repercussions.Understanding the legal framework surrounding these letters is paramount for all parties involved.

This section details the crucial legal aspects, relevant laws, potential ramifications, and the importance of meticulous information accuracy. This knowledge ensures secure and compliant transactions, safeguarding everyone’s interests.

Relevant Laws and Regulations

Authorization letters, especially those involving significant financial transactions, are governed by a multitude of laws and regulations, often at both the national and state levels. These laws encompass contract law, banking regulations, and potentially consumer protection laws, depending on the specific context. The exact laws applicable will depend on the jurisdiction and the nature of the transaction. For example, international wire transfers may be subject to international banking regulations, and specific regulations might apply to transactions involving minors or incapacitated individuals.

Potential Legal Ramifications of Improperly Drafted Letters

Improperly drafted authorization letters can expose parties to a range of legal issues. Ambiguity in the letter’s wording regarding the specific transactions authorized can lead to disputes over the extent of the authorization. This ambiguity can create uncertainty and potentially result in lawsuits, with the authorizing party bearing the responsibility for the actions of the person acting under the letter.

Failure to adhere to the proper legal format, such as missing essential clauses or not notarizing the document as required, can also lead to legal challenges, especially in situations where the validity of the authorization is contested.

Importance of Accurate and Complete Information

Accuracy and completeness are critical in authorization letters. Inaccurate or incomplete information can render the letter invalid or lead to misinterpretations. Incorrect account numbers, transaction amounts, or dates can create significant issues, potentially leading to unauthorized transactions or disputes over payment obligations. For instance, a small error in the recipient’s account number could cause funds to be transferred to the wrong account.

Summary of Legal Implications

| Authorization Type | Legal Implications | Relevant Legal Documents |

|---|---|---|

| General Authorization for Routine Transactions | Potential for disputes over the scope of authorization if not clearly defined. | Authorization letter, bank records |

| Authorization for Specific Transactions | Stricter requirements for accuracy in transaction details. Potential for legal challenges if transaction details are incorrect. | Authorization letter, bank records, transaction details |

| Authorization for International Transfers | Compliance with international banking regulations is critical. Potential for disputes related to currency conversion, exchange rates, and international legal jurisdiction. | Authorization letter, bank records, international banking regulations |

Different Scenarios and Applications: Authorization Letter Format For Bank

Authorization letters for banks are not a one-size-fits-all document. Their precise wording and structure must adapt to the specific transaction, ensuring legal validity and clarity. This section details how authorization letters are tailored to various banking transactions, from simple fund transfers to complex loan applications.

Authorization for Loan Applications

Loan applications necessitate comprehensive authorization letters. These letters grant the bank the authority to access and utilize specific financial information from the applicant, such as income statements, tax returns, and bank statements. They explicitly Artikel the permitted scope of information retrieval. The letter should clearly state the duration for which the authorization remains valid, preventing unauthorized access after a certain period.

A crucial aspect is the recipient’s acknowledgment of the letter’s terms.

Authorization for Account Management

Account management authorizations provide a broad mandate, enabling the designated party to perform various actions within the account. This may include initiating transactions, such as deposits or withdrawals, or making inquiries about account balances. The authorized party must be explicitly identified. The letter should specify the exact type of access, such as checking account balance or making transfers, to avoid any ambiguity.

Furthermore, it should stipulate the duration for which the authorization is active.

Authorization for Fund Transfers

Fund transfers require a concise and focused authorization letter. This letter explicitly identifies the sender, recipient, and amount of funds being transferred. The letter must clearly state the purpose of the transfer and the date of the transaction. An important element is the inclusion of the bank account numbers involved in the transfer to prevent errors. For example, an authorization for transferring a salary from one account to another would specify the dates of the transfer.

Authorization for Multiple Transactions

When multiple transactions are involved, the authorization letter must be more comprehensive. This covers various transactions over a specified period, such as recurring payments or regular transfers. The letter should clearly state the schedule of transactions, such as monthly payments. It should also include the exact dates of each transaction, providing a detailed record for future reference.

For example, a business owner authorizing payment for office supplies would include a schedule for recurring payments.

Table of Authorization Letter Examples

| Transaction Type | Purpose | Specifics |

|---|---|---|

| Loan Application | Granting access to financial information | Details of required documents, duration of authorization, and recipient’s acknowledgment. |

| Account Management | Enabling actions within the account | Types of access permitted, duration of authorization, and authorized party’s identity. |

| Fund Transfer | Authorizing the transfer of funds | Sender and recipient details, amount, purpose, and dates of transfer. |

| Multiple Transactions | Authorizing recurring or scheduled transactions | Transaction schedule, dates, and details for each transaction. |

Security and Confidentiality

Protecting authorization letters from fraud and misuse is paramount. The integrity and validity of these documents are crucial for the smooth functioning of financial transactions and prevent significant financial loss for both the authorizing party and the recipient institution. Robust security measures are essential to safeguard these documents and maintain trust in the financial system.

Importance of Secure Handling

Authorization letters often contain sensitive information, including account details, transaction limits, and specific instructions. Compromising this information can lead to unauthorized access and financial exploitation. Proper handling and storage procedures are vital to maintaining the confidentiality and integrity of these documents. This minimizes the risk of fraud and ensures compliance with legal regulations.

Best Practices for Preventing Fraud

Implementing robust security measures is key to preventing fraud. Careful review of the letter’s content, verification of the signatory’s identity, and adherence to established protocols are critical. Using secure electronic systems for storing and transmitting these documents, coupled with stringent access controls, significantly reduces the risk of unauthorized access and modification.

Secure Storage and Handling Procedures

Secure storage and handling procedures are fundamental to preventing fraud and misuse. Authorization letters should be stored in a secure location, accessible only to authorized personnel. Physical access control measures, such as locked cabinets and restricted areas, should be in place. Secure document management systems are highly recommended, especially for digital authorization letters. Regular audits of authorization letter handling procedures can identify potential vulnerabilities and ensure ongoing compliance.

Security Measures to Enhance Confidentiality

Several security measures can be implemented to enhance the confidentiality of authorization letters. These include physical security, access controls, encryption, and secure document management systems.

| Security Measure | Description | Implementation Steps |

|---|---|---|

| Physical Security | Protecting authorization letters from physical theft or damage. | Store letters in locked cabinets or secure rooms. Restrict access to designated personnel. Regularly audit security procedures. |

| Access Controls | Restricting access to authorization letters to authorized personnel. | Implement user authentication and authorization systems. Assign specific roles and responsibilities. Regularly review access privileges. |

| Encryption | Converting authorization letters into an unreadable format to prevent unauthorized access. | Use encryption software to protect sensitive data. Employ strong encryption algorithms. Regularly update encryption software. |

| Secure Document Management Systems | Implementing digital systems to manage and protect authorization letters. | Utilize secure cloud storage or internal servers. Implement robust access controls. Back up data regularly. |

| Regular Audits | Periodic reviews of authorization letter handling procedures. | Conduct regular audits to identify vulnerabilities. Review compliance with established procedures. Document findings and implement corrective actions. |

Addressing Common Issues

Crafting an authorization letter for a bank transaction requires meticulous attention to detail. Minor errors can lead to significant delays, rejection, or even fraudulent activity. Understanding potential pitfalls and their solutions is crucial for a smooth and secure process. This section highlights common issues and their resolution.

Identifying Ambiguous Language

Authorization letters must be crystal clear, leaving no room for misinterpretation. Vague phrasing or imprecise terms can lead to disputes and complications. This ambiguity can arise from unclear descriptions of the authorized actions, dates, amounts, or beneficiaries. For instance, using terms like “a substantial amount” or “some time next week” lacks the specificity needed for bank transactions.

Precise language is paramount to avoid disputes.

Ensuring Accurate Account Information

Correct account details are vital. Errors in account numbers, names, or routing numbers can result in the transaction being routed to the wrong account or rejected entirely. This is a critical step, often overlooked, leading to significant delays. Thorough verification of account details is essential.

Addressing Time Constraints and Deadlines

Authorization letters often have specific timeframes for validity. Failing to adhere to these deadlines can result in the authorization becoming invalid, requiring a new letter. This issue is amplified when the timeframe is short or the transaction is complex. Careful planning and attention to dates are crucial.

Specifying the Transaction Clearly

The letter must explicitly define the transaction’s nature, including the type of payment (e.g., wire transfer, check deposit), amount, and recipient. Inaccurate or incomplete transaction details can lead to incorrect processing or rejection. Avoid general descriptions and instead specify the exact transaction details.

Table of Common Authorization Letter Issues

| Potential Issue | Cause | Solution |

|---|---|---|

| Transaction rejection | Inaccurate account details or ambiguous transaction description | Double-check all account information and ensure the transaction details are precise and complete. |

| Authorization expiration | Missing or incorrect validity period | Specify a clear and unambiguous validity period for the authorization, well in advance of the transaction’s expected completion. |

| Misrouted funds | Incorrect routing information or ambiguous beneficiary details | Provide precise and complete routing information and beneficiary details to prevent misrouting. Include the full name and address of the beneficiary. |

| Fraudulent activity | Ambiguous or poorly worded authorization clauses | Use clear and precise language that minimizes opportunities for misinterpretation and fraud. Employ standardized templates where possible. |

| Delayed transaction processing | Lack of clarity in the authorization letter | Ensure all necessary details are present in the authorization letter. Employ standardized templates to reduce potential ambiguity. |

Illustrative Examples

Authorization letters, crucial for various financial transactions, demand meticulous attention to detail and legal precision. Understanding the practical application of these letters in diverse scenarios is vital for both the authorizing party and the recipient. These examples highlight the nuances and specific language required for effective communication and legal protection.

Loan Application Authorization Letter

This letter empowers a bank to access and utilize specific financial information from a borrower for a loan application. It’s crucial for demonstrating the borrower’s financial responsibility and capacity to repay the loan.

Example:To [Bank Name],This letter authorizes [Bank Name] to access and utilize my financial records, including bank statements, tax returns, and investment portfolios, for the purpose of evaluating my loan application for a [Loan Amount] loan. I understand that this information will be treated with the utmost confidentiality and used solely for the purpose of loan consideration.Sincerely,[Borrower Name][Borrower Signature][Date]

Payment Transaction Authorization Letter

This letter allows a party to authorize a payment transaction from one account to another. It specifies the amount, recipient, and purpose of the transaction.

Example:To [Bank Name],This letter authorizes [Bank Name] to transfer [Amount] from my account [Account Number] to [Recipient Name]’s account [Recipient Account Number]. The purpose of this transaction is [Purpose of transaction]. Please confirm receipt of this authorization.Sincerely,[Authorizer Name][Authorizer Signature][Date]

Account Closure Authorization Letter, Authorization letter format for bank

This letter formally requests the closure of a specific bank account. It clarifies the account details and the intended disposition of any remaining funds.

Example:To [Bank Name],This letter authorizes the closure of my account [Account Number]. I request that any remaining funds be transferred to my new account [New Account Number].Sincerely,[Account Holder Name][Account Holder Signature][Date]

Large Fund Transfer Authorization Letter

For substantial transfers, a comprehensive authorization letter is essential. It Artikels the recipient, purpose, and specific conditions, adding further clarity and security.

Example:To [Bank Name],This letter authorizes the transfer of [Amount] from my account [Account Number] to [Recipient Name]’s account [Recipient Account Number] located at [Recipient Bank Name]. The transfer is for [Purpose of Transfer]. The transfer should be completed within [Number] business days. Please confirm receipt of this authorization in writing.Sincerely,[Authorizer Name][Authorizer Signature][Date]

Table of Illustrative Examples

| Transaction Type | Example Letter | Key Clauses |

|---|---|---|

| Loan Application | Authorization to access financial records for loan evaluation | Specifies records to be accessed, purpose, confidentiality |

| Payment Transaction | Transfer of funds between accounts | Amount, recipient, purpose, confirmation request |

| Account Closure | Formal request to close an account | Account details, disposition of remaining funds |

| Large Fund Transfer | Transfer of substantial funds | Recipient, purpose, specific conditions, confirmation |

Final Thoughts

In conclusion, mastering the authorization letter format for bank transactions empowers you to navigate financial dealings with confidence and security. By understanding the key elements, legal considerations, and security measures, you can ensure smooth transactions and avoid potential pitfalls. This guide serves as a valuable resource, equipping you with the knowledge and tools to create legally sound and secure authorization letters for various banking needs.

Common Queries

What are the common mistakes to avoid when creating an authorization letter for bank transactions?

Ambiguity in the purpose of the authorization, missing signatures, and an unclear validity period are common pitfalls. Carefully define the specific action authorized, ensure all necessary signatures are present, and clearly state the timeframe for the authorization’s validity.

What are the legal implications of an improperly drafted authorization letter?

Improperly drafted letters may lead to invalid transactions, disputes, or legal challenges. Thorough research, careful drafting, and adherence to legal standards are crucial to avoid such issues.

How do I tailor an authorization letter for a specific transaction type?

The specific transaction type will dictate the required information and clauses. For instance, a loan application authorization will require different details compared to a payment authorization.

What security measures should I consider when handling authorization letters?

Secure storage, using encryption, and verifying the identity of the authorized party are essential security measures to protect the letter from fraud or misuse. Use appropriate channels for transmitting the letter.