Example of auto insurance card sets the stage for this insightful exploration, delving into the critical aspects of these essential documents. From understanding their fundamental purpose to navigating the nuances of various formats, this guide provides a clear and comprehensive overview.

This resource examines the components of a typical auto insurance card, highlighting the essential information typically found on both physical and digital versions. It also explores the importance of possessing and correctly utilizing this vital document in diverse situations, from routine traffic stops to the unfortunate event of an accident.

Defining an Auto Insurance Card

Yo, peeps! So, you’re lookin’ to understand what exactly that little piece of plastic (or digital file!) is all about? It’s your essential buddy on the road, your proof of protection, and your gateway to peace of mind when things get a little bumpy. Let’s dive in!This card is your official documentation of your auto insurance policy.

It’s like a superhero license, proving you’ve got the coverage you need to keep your wheels rolling safely.

What is an Auto Insurance Card?

An auto insurance card is a document that proves your vehicle is insured. It’s a vital piece of information for you and others on the road. It’s your insurance passport, detailing the specifics of your policy, and ultimately, your financial safety net in case of an accident.

Purpose of an Auto Insurance Card

The main purpose of an auto insurance card is to provide crucial information about your insurance policy to anyone involved in an accident or to law enforcement. This ensures that claims are processed smoothly and that everyone is covered under their insurance agreements. It’s also a helpful document to have for quick access to your coverage details while on the road.

Information on an Auto Insurance Card

Your auto insurance card typically contains essential details, like your policy number, the insurance company’s name, your name and contact info, and the coverage limits for your vehicle. It also lists the effective dates of your policy and your vehicle’s identification number. This comprehensive information ensures everyone knows who’s covered in the event of a claim. Think of it as your insurance policy summary, neatly packaged for easy reference.

Types of Auto Insurance Cards

Modern insurance is all about convenience! You’ve got two main options:

- Physical Card: The classic, tangible card. This is a physical piece of plastic you keep in your car’s glove compartment or a designated spot. It’s good for a quick reference while on the go.

- Digital Card: This is the digital age’s solution! Your insurance details are stored in a digital format. You can access them through a mobile app or your insurance provider’s website, eliminating the need for a physical card. This is convenient for keeping your insurance info accessible on your phone, and a super helpful tool in case of a digital emergency.

Both options are designed to give you easy access to your insurance details. Choose the method that works best for you! If you’re tech-savvy, the digital option will likely be more practical. If you’re a bit more traditional, a physical card might suit your style better. Either way, your insurance details are right there, ready to protect you.

Components of an Auto Insurance Card

Hey Bali babes! Your ride’s safety is super important, and your insurance card is your key to smooth sailing. Knowing what’s on it makes claiming a breeze. Let’s dive into the essential bits.Understanding the details on your auto insurance card empowers you to handle any situation with confidence, whether it’s a minor fender bender or a more serious accident.

This knowledge will make you feel way more secure on the road, knowing you’ve got your bases covered.

Essential Elements on a Standard Auto Insurance Card

Knowing the vital info on your card is crucial. It’s your quick reference for important details, like your policy number and contact info. This helps in speedy claims and ensures everything runs smoothly.

| Component | Description | Example | Importance |

|---|---|---|---|

| Policy Number | A unique identifier for your insurance policy. | 1234567890 | Crucial for locating your policy and filing claims. |

| Policyholder Name | The name of the person or entity who owns the policy. | Jane Doe | Identifies the policy owner and helps in claim processing. |

| Vehicle Information | Details about the insured vehicle(s), like the VIN, make, model, and year. | 2023 Toyota Camry, VIN: ABC1234567890 | Important for accurately identifying the insured vehicle and any damages. |

| Insurance Company Information | Details about the insurance provider, including their name, address, and contact number. | Bali Insurance Co., 123 Main St, Bali, +62 81234567890 | Essential for contacting the insurance company if needed. |

| Coverage Details | A summary of the coverages included in the policy, like liability, collision, and comprehensive. | Liability: 300,000, Collision: Included | Provides a quick overview of your policy’s scope and limits. |

| Contact Information | Contact details for the insurance company or claims department. | Claims Line: 081234567890, Customer Service: 081234567891 | Allows for immediate contact in case of accidents or issues. |

Comparing Physical vs. Digital Auto Insurance Cards

Digital cards are super convenient and eco-friendly, while physical cards are still widely used. This table highlights the key differences:

| Feature | Physical Card | Digital Card | Trend |

|---|---|---|---|

| Format | Printed card | App-based or online portal | Digital cards are gaining popularity |

| Portability | Carry it with you, easy access | Access from your phone, anywhere | Digital cards win for portability |

| Security | Potentially lost or stolen | Protected by phone security features | Digital cards are secure |

| Cost | Usually less expensive for printing | No extra cost, just using your phone | Digital cards are more cost-effective |

| Environmental Impact | Consumes paper | Eco-friendly | Digital cards are better for the environment |

Digital Auto Insurance Card Format

Digital auto insurance cards are a super cool way to keep your insurance info handy. They’re stored in a secure app or online portal on your phone, and are accessible anytime, anywhere.

A digital card often displays all the essential details of a traditional insurance card, allowing quick access and avoiding the need for a physical copy.

Typically, a digital card provides quick access to your policy information, making claims processing efficient and seamless. The layout is generally user-friendly and visually appealing, designed for easy navigation and retrieval of details. This modern format is super practical for today’s lifestyle.

Importance and Usage of an Auto Insurance Card

Yo, fellow Bali drivers! Having the right auto insurance is super crucial, especially in this awesome island paradise. Your insurance card isn’t just a piece of paper; it’s your ticket to smooth sailing on the road and a valuable tool in various situations.Having your auto insurance card handy is like having a secret weapon. It proves your coverage, ensuring you’re protected if anything goes sideways.

It’s also your go-to document for resolving any issues with the authorities or insurance companies.

Need a sample auto insurance card? Plenty of sites have examples, but if you’re looking for a Christmas Day lunch spot in Melbourne for 2024, check out this resource for Christmas Day lunch in Melbourne 2024. Having your auto insurance card handy is key, just like having a reservation for a good meal. Knowing the details of your coverage is crucial, and an example card can help you verify that your information is correct.

Crucial Role in Accidents

Insurance cards are your lifesaver in case of a fender bender or a more serious accident. It’s the first thing you’ll need to present to establish responsibility and initiate the claim process. Having your card readily available ensures a smooth, less stressful process for everyone involved. It’s a game-changer, especially in unfamiliar situations.

Essential During Traffic Stops

When you get pulled over by the authorities, having your auto insurance card is key. It confirms you’re legally covered and that you’re complying with traffic regulations. This saves time and hassle, especially if there’s any question about your insurance status.

Presenting Your Insurance Card to an Officer: A Step-by-Step Guide

Here’s how to show your auto insurance card like a pro:

- Pull out your insurance card and place it in a clear, easily accessible spot.

- Smile and politely offer the card to the officer.

- Ensure the officer can easily read all the details on the card. Make sure the card isn’t folded or damaged.

- If asked for any additional documents, be ready to present them.

- Thank the officer for their time.

Instances Where Your Insurance Card is a Must

Your auto insurance card isn’t just for accidents; it’s your essential companion in many situations.

- Claims Process: If you have to file a claim, your insurance card provides crucial information to the insurance company. This avoids delays and ensures your claim is processed efficiently. Think of it as the key to unlocking your coverage.

- Insurance Disputes: If there’s a disagreement regarding coverage or responsibilities, your insurance card serves as the primary evidence of your policy. It helps in quickly resolving disputes and avoiding potential legal issues.

- Insurance Audits: In certain cases, insurance companies or authorities may require your insurance card for verification purposes. Having it ready avoids complications and allows for a smooth verification process.

- Legal Proceedings: In some legal situations involving your vehicle, your insurance card is essential to demonstrate your coverage. This avoids misunderstandings and proves your legal compliance.

Variations and Alternatives to Traditional Cards: Example Of Auto Insurance Card

Gone are the days of just a flimsy paper card! Modern auto insurance is way more digital, making things easier and safer. Now you can access all your important info on your phone, which is super convenient, especially when you’re on the go.Today’s insurance world is all about making things simpler and more accessible. No more fumbling through drawers for that card – everything’s right at your fingertips.

Digital Auto Insurance Access

Digital access to your auto insurance info is a game-changer. Forget lugging around a physical card; everything is now available online and in apps. This shift towards digital solutions offers unparalleled convenience and security.

Comparing Digital and Physical Cards

| Feature | Digital Card | Physical Card |

|---|---|---|

| Accessibility | Instant access anywhere, anytime, via your phone or computer | Limited to physical location where the card is held |

| Security | Enhanced security measures like encryption and two-factor authentication | Potentially more vulnerable to loss or theft |

| Portability | Highly portable, accessible from any device with internet connectivity | Limited portability, only accessible when the card is present |

| Cost | Generally free, part of your insurance plan | May involve printing costs |

Finding Your Digital Auto Insurance Info

Locating your auto insurance details digitally is straightforward. Your insurance provider’s website or mobile app will have a dedicated section for your policy information. This area usually includes your policy number, coverage details, contact information, and other relevant data. It’s often as simple as logging in with your username and password.

Accessing Information in a Mobile App

Your insurance provider’s mobile app is a one-stop shop for all your auto insurance needs. It’s like having your entire policy at your fingertips. You can view your policy details, make payments, file claims, and even communicate with customer service directly through the app. Just download the app from your app store, create an account, and you’re good to go.

It’s the ultimate convenience for managing your auto insurance.

Illustrative Examples

Whoa, let’s dive into the awesome world of auto insurance cards! Imagine a sleek, digital card that’s super convenient, or a physical one that’s just as reliable. We’ll show you some rad examples and how they’re used in everyday situations.

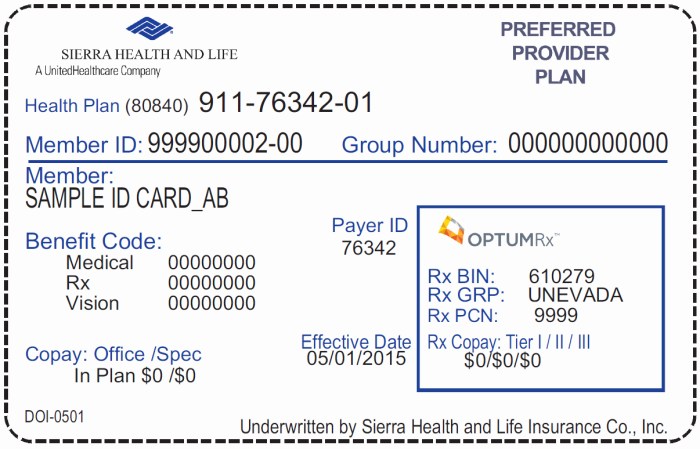

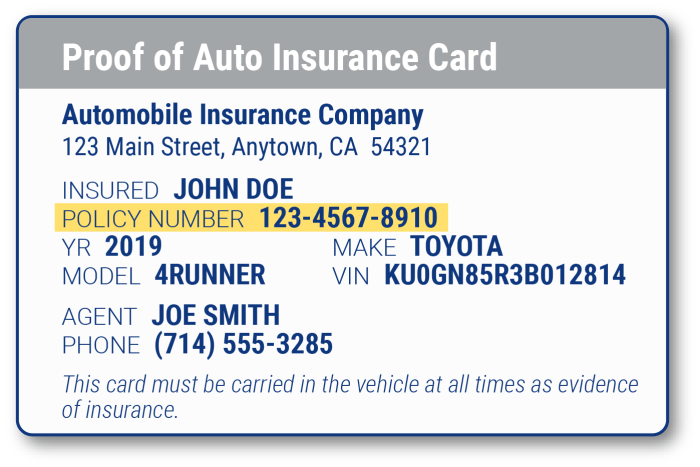

Visual Representation

Auto insurance cards come in two cool forms: physical and digital. A physical card is like a little passport for your car, often made of sturdy plastic, with all the essential info printed on it. It’s got a professional look, like a mini-document, and it’s easy to whip out when needed. A digital card is like a virtual version, stored in your phone or online account.

Need a quick example of an auto insurance card? It’s often one of the crucial documents landlords need to see when you’re applying to rent an apartment, alongside things like your pay stubs and references. Knowing what documents required to rent an apartment are is key. So, make sure your auto insurance card is up-to-date and readily available for your rental application process! This way, you’ll avoid any last-minute headaches.

It’s super handy because you can access it instantly, just a tap away. It’s a great option for people who love digital life and want to avoid carrying physical cards.

Scenario: The Traffic Stop

Imagine this: You’re cruising along a Bali road, enjoying the scenery, when BAM! A traffic officer pulls you over. They ask for your insurance. You need to quickly show them proof that your ride is covered. This is where your auto insurance card comes in super handy. You pull out the physical card or quickly access the digital version on your phone.

The officer verifies the information, confirms your coverage, and you’re good to go, back on the road, feeling secure. This is a crucial example of how the card proves your car is insured, keeping you from any hassles.

Sample Auto Insurance Card Information, Example of auto insurance card

Your auto insurance card holds some important details, just like a super-powered ID for your car. Let’s take a look at the essential info you’ll find on a typical card:

- Policyholder Information: This section shows your name, address, and contact details. It helps them quickly identify who the policy is for.

- Insurance Company Details: This is where you find the name and logo of the insurance company, letting everyone know who’s protecting your wheels.

- Policy Number: This is the unique code for your insurance policy. It’s like a secret key to unlocking your coverage details.

- Vehicle Information (often included): Sometimes, the card will also list your car’s details, like the make, model, and registration number.

- Effective Dates: The period when your insurance policy is valid. This helps you quickly check if your insurance is still active.

- Contact Information for the Insurance Company: Phone number, website, and possibly an email address to contact them for any queries.

This is the core info that’s essential to verify your insurance details. Remember, it’s like your car’s insurance passport, and having it readily available is super important.

Comparison Across Insurance Providers

Insurance cards, like those stylish surfboards, come in all shapes and sizes. Different providers have their own unique ways of presenting your policy details, making it a little like trying to find the perfect wave – sometimes you just gotta ride with what you get. But understanding the differences can help you easily find the info you need, no matter which insurer you’re with.Different insurance companies have varying design aesthetics for their auto insurance cards, similar to how different cafes have different vibes.

Some are sleek and minimalist, while others are packed with information. This is reflected in the formatting, layout, and inclusion of specific details. Understanding these variations can make comparing policies a breeze, like navigating Bali’s amazing roads – smooth and clear!

Variations in Formatting and Layout

Insurance companies often use different layouts for their auto insurance cards. Some cards feature a large, prominent logo, while others prioritize a concise, easily readable format. Font sizes, colors, and the placement of information can all vary significantly. This variability reflects the diverse brand identities and design preferences of different insurance providers. Think of it like choosing a favourite Balinese restaurant – each has its own unique charm and ambiance!

Common Elements Across Providers

Despite the variations, common elements appear on most auto insurance cards. These include essential information like the policyholder’s name, policy number, vehicle details, and contact information. This consistency ensures that the crucial information is readily accessible, regardless of the specific provider. This is like the essential ingredients in a perfect Nasi Goreng – they always have to be there!

- Policyholder’s Name and Contact Information: Essential details for quick contact, like your name, address, and phone number.

- Policy Number: A unique identifier for your policy, crucial for claims and correspondence.

- Vehicle Information: Details about the insured vehicle, such as the make, model, year, and vehicle identification number (VIN). This helps ensure the correct vehicle is covered.

- Insurance Company Information: Name and contact information for the insurance company, like a trustworthy local guide in Bali.

- Policy Effective Dates: The start and end dates of your policy, so you know when your coverage is valid.

Comparison Table

The following table provides a simplified comparison of how different insurance providers present their auto insurance card information. It’s like a quick guide to help you navigate the different styles, much like a local guide in Bali.

| Insurance Provider | Card Format | Key Features | Layout |

|---|---|---|---|

| Company A | Modern, minimalist | Clear, concise details; emphasis on policy number | Large font for policy number, smaller font for other details |

| Company B | Traditional, comprehensive | Includes detailed coverage information; larger font sizes | Sections for different coverages |

| Company C | Digital-first | Emphasis on online access; QR codes for quick access | Minimal physical card; detailed information online |

Final Review

In conclusion, understanding your auto insurance card is paramount. This guide has thoroughly examined the various aspects of these documents, from their basic definition to practical applications. By grasping the key elements and recognizing the different formats, you’ll be well-prepared to handle any situation requiring this critical piece of information. This empowers you to navigate the complexities of car insurance with confidence.

FAQ Compilation

What information is typically found on a physical auto insurance card?

A physical auto insurance card usually includes the policyholder’s name, the insurance company’s name and address, the policy number, the vehicle identification number (VIN), and the coverage details.

How can I access my auto insurance information digitally?

Many insurance companies offer digital access through mobile apps or online portals. You can typically log in using your account credentials to view your policy details, make payments, and access your insurance card.

What should I do if I lose my physical auto insurance card?

Contact your insurance provider immediately to request a replacement card or access to your digital insurance information. They will likely guide you through the process.

Are there differences in how different insurance companies format their cards?

Yes, there can be variations in formatting and layout. Some companies might prioritize specific information, use different fonts or colors, or employ various visual elements.