How much does gap insurance cost per month? Figuring out the price can feel like navigating a maze, but fear not, this guide will cut through the confusion. We’ll explore the key factors impacting premiums, from your car’s make and model to the insurance provider’s pricing model. Get ready to unlock the secrets to scoring the best deal!

Understanding the different calculation methods, coverage options, and ways to minimize costs is crucial. We’ll break it down in a super easy-to-understand way, so you can confidently compare quotes and find the perfect gap insurance policy for your needs.

Factors Affecting Gap Insurance Costs

Gap insurance premiums are not a fixed amount; they vary based on several key factors. Understanding these variables allows consumers to make informed decisions about their coverage needs and potentially find more affordable options. These factors are crucial in determining the final cost, influencing the overall value and suitability of the insurance for individual circumstances.

Vehicle Characteristics

The make, model, and year of the vehicle significantly impact gap insurance premiums. Vehicles with higher retail values, especially those considered luxury or high-performance models, generally have higher gap insurance premiums. This is because the gap between the vehicle’s depreciated value and the outstanding loan amount is likely to be greater. For example, a new, high-end sports car might depreciate more rapidly than a standard sedan of the same year, resulting in a larger gap that the insurance needs to cover.

Older vehicles, especially those nearing the end of their useful life, might also have higher premiums, as their residual value is lower and thus the gap greater.

Loan Terms

The terms of the loan play a significant role in determining gap insurance costs. The loan amount itself is a direct factor; a larger loan amount translates to a larger potential gap between the loan value and the car’s depreciated value. Higher interest rates also tend to increase premiums. Longer loan terms often lead to higher premiums as the vehicle depreciates more over the life of the loan.

For instance, a 7-year loan for a vehicle with a high depreciation rate would likely cost more in gap insurance than a 5-year loan for the same vehicle.

Insurance Provider Pricing Models

Insurance providers employ various pricing models to determine gap insurance premiums. Some companies might base their premiums on a percentage of the loan amount, while others might use a more complex formula that considers factors like the vehicle’s age, market value, and anticipated depreciation rate. The provider’s specific pricing model is a critical element in determining the gap insurance cost.

A provider that prioritizes comprehensive risk assessment and factors in the specifics of each vehicle and loan might have a different pricing structure than one that primarily focuses on the loan amount.

Creditworthiness

Creditworthiness can indirectly influence gap insurance premiums. Insurance providers may use credit scores to assess the risk associated with the loan. Individuals with lower credit scores might experience higher premiums as lenders perceive them as having a greater risk of default. Although not directly linked to the vehicle, a poor credit score might impact the loan terms, thus increasing the gap insurance cost.

A whisper of a question dances on the wind: how much does gap insurance cost per month? The answer, like a phantom, shimmers and shifts, depending on the specifics of your situation. Digging deeper into the mysteries of the Forbes Funeral Home Sturgeon Bay obituaries forbes funeral home sturgeon bay obituaries might offer a chillingly precise glimpse into the financial uncertainties of life.

But still, the precise cost of gap insurance remains a whispered secret, a tantalizing enigma, waiting to be revealed only to those with a keen eye and a steely resolve.

This is because lenders might impose higher interest rates or stricter loan conditions, ultimately leading to a larger gap.

Factors Influencing Gap Insurance Costs: A Summary

| Factor | Potential Impact |

|---|---|

| Vehicle Make, Model, and Year | High |

| Loan Amount | High |

| Interest Rate | Medium |

| Loan Duration | Medium |

| Insurance Provider Pricing Model | Medium |

| Creditworthiness | Low |

Methods for Calculating Gap Insurance Costs

Gap insurance premiums are calculated using various methods, reflecting the complexity of assessing the difference between the vehicle’s value and the outstanding loan amount. Understanding these methods is crucial for consumers to make informed decisions and compare offers effectively. Insurance providers often employ different approaches to arrive at a monthly premium, impacting the final cost.Insurance companies meticulously consider several factors to determine a fair and accurate gap insurance premium.

These calculations aim to balance the need to cover potential financial losses with the cost of the insurance itself. Different pricing models exist, and each one influences the final premium amount.

Methods for Determining Monthly Premiums

Insurance companies use various methods to calculate monthly premiums for gap insurance. These methods often incorporate actuarial science and statistical models to predict future depreciation and potential loan amounts. Some key methods include a fixed percentage of the loan amount, a variable premium based on depreciation rate, and a premium tied to the vehicle’s residual value. Factors like the vehicle’s make, model, and condition are also considered.

Step-by-Step Calculation Process

Insurance companies generally follow a multi-step process to calculate gap insurance premiums. These steps ensure accuracy and consistency.

- Assessment of Loan Details: The insurance company first assesses the loan details, including the loan amount, interest rate, and loan duration. A higher loan amount and longer loan term typically result in a higher gap insurance premium. For instance, a loan of Rp. 100 million with a 5-year duration will incur a higher premium compared to a Rp. 50 million loan with a 3-year duration.

- Vehicle Valuation: The current market value of the vehicle is determined. This often involves using independent appraisal methods or industry-standard valuation tools. This is crucial as the gap amount is based on the difference between the loan amount and the vehicle’s market value.

- Depreciation Calculation: Vehicle depreciation is a critical factor in gap insurance cost calculation. The rate of depreciation is calculated based on various factors, including the vehicle’s age, mileage, make, model, and condition. High depreciation rates often lead to higher gap insurance premiums. For example, a luxury car that depreciates quickly may have a higher premium than a more durable economy car.

- Gap Amount Determination: The difference between the outstanding loan amount and the vehicle’s current market value is calculated. This is the gap amount, and it’s the primary factor used in calculating the insurance premium.

- Premium Calculation: The gap insurance premium is calculated using the selected pricing model. This model might be a fixed percentage of the gap amount, a variable rate based on factors like vehicle type, or a premium linked to the vehicle’s residual value.

Comparison of Pricing Models

Different insurance providers employ various pricing models for gap insurance.

| Pricing Model | Description | Potential Impact on Cost |

|---|---|---|

| Fixed Percentage | A fixed percentage of the loan amount is applied to calculate the premium. | Can be predictable but may not reflect actual depreciation. |

| Variable Premium | The premium is based on the calculated rate of depreciation, with higher rates resulting in higher premiums. | More accurately reflects depreciation but can be less predictable. |

| Residual Value-Based | The premium is tied to the vehicle’s predicted residual value, accounting for factors like mileage and market conditions. | Accurately reflects the vehicle’s future value but may be more complex to calculate. |

Influence of Loan Details

Loan details significantly influence gap insurance cost calculations. The loan amount, interest rate, and loan duration directly affect the gap amount and, consequently, the premium.

A larger loan amount will result in a larger gap amount and a higher premium. A higher interest rate might increase the outstanding loan balance over time, potentially increasing the gap amount.

Importance of Vehicle Depreciation

Vehicle depreciation plays a pivotal role in determining gap insurance premiums. A higher depreciation rate directly translates to a larger gap amount and a higher premium. Insurance companies utilize various methods to predict and incorporate depreciation into the calculation process. A vehicle’s depreciation rate depends on factors such as its age, mileage, make, model, and market conditions.

Comparing Gap Insurance Costs Across Providers

Gap insurance, designed to cover the difference between the actual cash value of a vehicle and its outstanding loan balance, can vary significantly in cost between different providers. Understanding these variations is crucial for consumers to make informed decisions and secure the best possible coverage at a reasonable price. This comparison examines the pricing strategies of major gap insurance providers, identifies contributing factors, and offers a method for evaluating quotes effectively.Insurance providers employ diverse pricing strategies for gap insurance.

Some companies may base their premiums on factors like vehicle type, loan amount, and the vehicle’s age. Others may utilize a more generalized approach, applying a percentage markup to the loan amount. These differences in approach lead to substantial variations in the final cost of the coverage.

Variations in Gap Insurance Pricing Strategies

Different insurance providers often utilize distinct pricing models. Some providers may offer competitive rates by emphasizing comprehensive coverage packages, which may include gap insurance at a bundled price. Others might focus on specialized vehicle types, like luxury cars or high-value collector models, and tailor their pricing accordingly. A provider’s approach to pricing gap insurance can be influenced by their overall business strategy, their understanding of the market, and their cost structures.

Factors Contributing to Pricing Differences

Several key factors influence the gap insurance cost variations between providers. The vehicle’s make, model, and year significantly affect the pricing, as some vehicles are more susceptible to depreciation than others. The amount of the outstanding loan is another significant determinant; larger loans generally result in higher premiums. Furthermore, the insurance provider’s operational costs, including overhead and profit margins, directly impact the final pricing.

Comparing Gap Insurance Quotes

Comparing quotes from various providers is essential for securing the most favorable terms. A systematic approach is needed to compare apples to apples. Consumers should gather quotes from multiple providers, ensuring that all quotes include similar coverage options. Scrutinizing the fine print, including any exclusions or limitations, is crucial. Ultimately, the best method involves comparing the total cost of gap insurance across different providers while considering the coverage provided.

Average Monthly Costs for Gap Insurance

| Provider | Vehicle Type (Example) | Average Monthly Cost (USD) |

|---|---|---|

| Company A | Compact Car (2023 Model) | $25 |

| Company A | Luxury SUV (2022 Model) | $50 |

| Company B | Compact Car (2023 Model) | $30 |

| Company B | Luxury SUV (2022 Model) | $65 |

| Company C | Compact Car (2023 Model) | $20 |

| Company C | Luxury SUV (2022 Model) | $45 |

Note: These figures are illustrative examples and may vary depending on specific loan terms, vehicle conditions, and other factors.

Whispers on the wind suggest gap insurance costs vary, a tickle of uncertainty in the market. Homes for sale in New Boston, MI ( homes for sale new boston mi ) might influence the price, but the exact monthly cost remains an enigmatic dance between the unknown and the predictable. A shiver of intrigue still lingers around how much gap insurance truly costs per month.

Indirect Influence of Customer Service and Reputation

While not a direct pricing factor, a provider’s reputation and customer service can indirectly affect pricing. Consumers often prefer providers with a positive track record and reliable customer support. This preference can lead to higher demand for those services, which might translate into slightly higher pricing. A provider’s positive reputation might attract a higher clientele, thus potentially influencing the cost of gap insurance.

Understanding Different Gap Insurance Coverage Options

Gap insurance policies offer varying levels of coverage to protect against financial losses due to unforeseen circumstances. Understanding these different coverage levels is crucial for making an informed decision. Choosing the right coverage level impacts the monthly premium and the extent of protection against potential losses.Gap insurance coverage options vary significantly, offering different degrees of financial protection. The extent of this protection, and consequently the cost, depends on the specific coverage level chosen.

A higher coverage level provides broader protection, but at a higher monthly cost. Understanding the implications of different coverage levels and their effect on the monthly premium is essential for budgeting and financial planning.

Different Coverage Levels and Their Implications

Various levels of coverage are available in gap insurance policies, each with distinct implications for the monthly premium and the level of protection. Choosing the right coverage level involves balancing the desired level of protection with the associated financial implications. The coverage options are designed to meet a range of needs and budgets.

Coverage Levels and Monthly Costs

The following table illustrates different gap insurance coverage levels, their descriptions, and corresponding estimated monthly costs. Note that these are illustrative examples and actual costs may vary based on factors such as the vehicle’s make and model, the deductible amount, and the specific insurance provider.

| Coverage Level | Description | Estimated Monthly Cost (USD) |

|---|---|---|

| Basic Coverage | Covers a portion of the gap between the vehicle’s depreciated value and the outstanding loan amount. | $20-$50 |

| Standard Coverage | Covers a larger portion of the gap, typically including the full depreciated value minus the outstanding loan amount. | $50-$100 |

| Comprehensive Coverage | Covers the entire gap between the vehicle’s value and the outstanding loan amount, including potential depreciation and other unforeseen circumstances. | $100-$200 |

Exclusions and Limitations

It is vital to understand the exclusions and limitations associated with each coverage level. These limitations define the specific circumstances where the coverage will not apply. Policies may exclude certain types of damage or accidents, such as those caused by intentional acts. Carefully reviewing the policy’s fine print is crucial to avoid any surprises or disappointments after a claim.

Always check the exclusions and limitations carefully to ensure the coverage meets your needs.

Impact of Gap Coverage Amount on Premium

The amount of gap coverage directly influences the premium. A larger gap coverage amount typically results in a higher monthly premium. This relationship is generally linear, meaning that a doubling of the gap coverage amount will likely result in a similar increase in the monthly premium. Understanding this relationship allows for a better understanding of the financial implications of different coverage levels.

Tips for Minimizing Gap Insurance Costs

Reducing the monthly cost of gap insurance requires a strategic approach. Understanding the factors influencing premiums and employing effective negotiation techniques can significantly lower the overall expense. A proactive approach to comparing policies and exploring available discounts is crucial for securing the most affordable coverage.

Strategies for Reducing Monthly Costs

Several practical strategies can help minimize gap insurance premiums. These strategies involve proactive steps, including comparing quotes and negotiating with providers. By understanding the factors that affect costs, consumers can make informed decisions to reduce their financial burden.

- Compare Quotes from Multiple Providers: Thorough comparison shopping is essential. Different insurance providers offer varying premiums for gap insurance, based on their underwriting practices and profit margins. Consumers should seek quotes from several reputable providers, considering their reputation and customer reviews. For instance, comparing quotes from three different companies can reveal substantial price differences, potentially saving hundreds of dollars annually.

- Negotiate with the Provider: Don’t hesitate to negotiate the premium. Many providers are willing to adjust rates if presented with a compelling case, especially if the policyholder has a strong track record with the company or if the coverage aligns with specific needs. A polite but firm negotiation, highlighting the value proposition, can sometimes yield a more favorable premium.

- Explore Available Discounts: Gap insurance providers often offer discounts for various reasons. These may include discounts for multiple policies, bundled insurance products, or loyalty programs. Consumers should inquire about any potential discounts that could lower their premiums.

- Consider Coverage Options Carefully: The level of coverage significantly affects the premium. For example, policies with limited coverage for depreciation may have lower premiums than those offering broader coverage. A comprehensive evaluation of the required coverage and a realistic assessment of potential depreciation can help tailor the policy to minimize costs while ensuring adequate protection.

- Review the Policy Regularly: The need for gap insurance may diminish over time. Periodically reviewing the policy, and adjusting the coverage or even canceling the policy when deemed unnecessary, can save substantial amounts. If the vehicle’s value approaches the loan amount, consider whether gap insurance is still required.

Steps to Find the Most Affordable Gap Insurance Policy

Finding the most affordable gap insurance policy involves a systematic approach. This includes proactive comparison and analysis to ensure the best value for the desired coverage.

- Gather Information: Compile details about the vehicle, loan terms, and desired coverage level. This information forms the basis for comparing quotes and negotiating with providers.

- Request Quotes from Multiple Providers: Contact several insurance providers to receive personalized quotes for gap insurance. Comparing these quotes helps identify the most affordable option.

- Analyze Coverage Options: Understand the different coverage options available. Compare the features, benefits, and exclusions to find a policy that balances cost and protection.

- Negotiate with the Provider: If possible, negotiate the premium with the provider to potentially lower the cost. Highlighting any favorable factors can increase the chances of a more favorable agreement.

- Evaluate Discounts: Inquire about any discounts offered by the provider. This can significantly reduce the monthly premium.

Illustrative Examples of Gap Insurance Costs

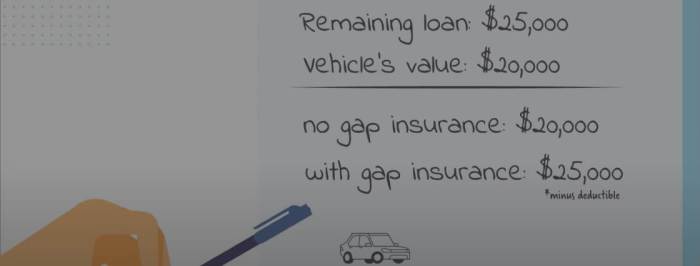

Gap insurance, designed to bridge the difference between a vehicle’s loan value and its market value in case of a total loss or damage, is a crucial component of car ownership, particularly for those with loans. Understanding how gap insurance costs are determined and how various factors influence those costs is essential for making informed financial decisions.The cost of gap insurance is not static; it varies depending on the specific car, loan terms, and market conditions.

Factors like the vehicle’s age, make, model, and prevailing market values, along with the loan’s terms and conditions, all play a role in shaping the final premium. This section will provide concrete examples to illustrate these complexities.

Scenario 1: Purchasing a New Car

A customer, Amelia, purchases a new sedan valued at Rp 300,000,000. She finances the purchase with a loan of Rp 250,000,000. The loan term is 5 years. The loan interest rate is 10% per year. In this scenario, the gap amount is the difference between the loan amount and the estimated value of the car at the time of the loan.

The car depreciates over time. Thus, the gap insurance will be calculated on the expected loan value at the time of the loan.The monthly cost of gap insurance will depend on the insurance provider’s rates, and the estimated depreciated value of the car. Since this is a new car, the gap amount is initially high, and so is the monthly premium.

However, as the car depreciates, the gap amount and, consequently, the monthly premium will decrease.

Scenario 2: Comprehensive Car Loan Example, How much does gap insurance cost per month

Consider a loan for a used car. Let’s say the car is a 2020 model, with an initial market value of Rp 250,000,000. The loan amount is Rp 200,000,000 for 4 years, with a 12% interest rate. The monthly installment is Rp 5,000,000.

The gap amount will be the difference between the loan amount and the car’s depreciated value after each year.

The insurance provider will assess the car’s depreciation rate based on the market value. This will impact the gap amount and consequently the premium. The monthly installment will affect the loan value and consequently the gap insurance cost. The insurance company will provide the gap amount and the premium rate.

Illustrative Cost Calculation

To illustrate the cost calculation, let’s use a fictional scenario. A customer, Mr. Budi, buys a 2023 Honda Civic with a loan of Rp 220,000,000 for 4 years. The estimated residual value of the car after 4 years is Rp 150,000,000. The insurance company estimates a 10% annual depreciation rate.

| Year | Estimated Car Value | Gap Amount | Estimated Monthly Premium |

|---|---|---|---|

| Year 1 | Rp 200,000,000 | Rp 70,000,000 | Rp 1,200,000 |

| Year 2 | Rp 180,000,000 | Rp 60,000,000 | Rp 1,000,000 |

| Year 3 | Rp 160,000,000 | Rp 50,000,000 | Rp 800,000 |

| Year 4 | Rp 150,000,000 | Rp 40,000,000 | Rp 600,000 |

This table shows how the gap amount and the corresponding premium decrease over time as the car depreciates.

Determining the Gap Amount and Premium

To determine the gap amount, subtract the estimated residual value of the vehicle from the outstanding loan amount. The insurance company will use its own depreciation models and actuarial tables to determine the premium based on the gap amount and other factors. The insurance company will provide a clear explanation of the calculation method.

Ending Remarks: How Much Does Gap Insurance Cost Per Month

So, there you have it! Navigating the world of gap insurance doesn’t have to be a headache. By understanding the factors that influence costs, comparing providers, and exploring different coverage options, you’re well on your way to finding the best possible gap insurance deal. Remember, comparing quotes and negotiating are your ultimate weapons in this game! Happy saving!

User Queries

What if my credit score isn’t the best?

Your credit score might slightly impact your gap insurance premium, but it’s not the sole determinant. Lenders and insurers often look at other factors like your driving history and the vehicle’s value to assess risk.

Are there any discounts for gap insurance?

Some providers offer discounts for bundling gap insurance with other insurance policies or for maintaining a clean driving record. It’s always worth checking with different providers to see what discounts might be available to you.

How does vehicle depreciation affect the cost?

Depreciation is a major factor. Older or less valuable cars often have lower gap insurance premiums because the gap amount is smaller.

What’s the difference between different coverage levels?

Different coverage levels correspond to different premium amounts. Higher coverage means a larger gap amount and usually a higher monthly premium.